Australia shames non-tax paying firms The Australian Taxation Office (ATO) has shamed large corporates by publishing revenue and tax information of more than 1,500 companies with reported total earnings over A$100 million (US$72.11 million) for...

Read MoreStudent loans

Student loans – sharing with Australia Compliance with student loan repayment obligations remains a continued focus for IRD and the Government. IRD currently estimates that $3.2billion is owed by student loan borrowers who are currently living...

Read MoreStructuring

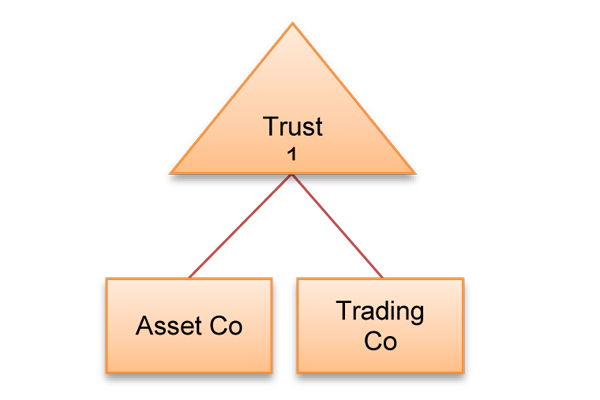

Structuring – to put your eggs in different baskets or not? When establishing a business, there are a number of considerations to take into account to determine the ideal structure to adopt. One such consideration is protection of assets, not...

Read MoreChanges to IRD

Changes to the IRD’s administration system The manner in which we interact with Inland Revenue (IRD) is likely to change dramatically over the next two years as the upgrade of IRD’s IT system and associated legislation comes on-line. IRD’s broad...

Read MoreEmployer provided carparks

Employers are required to pay FBT on non-cash benefits provided to staff. However, like most taxes, there are exemptions. It is important to be aware of the exemptions to ensure FBT is not overpaid. One such exemption provides that benefits ...

Read More